Ownera co-authors landmark report — The Case for Collateral Mobility in Europe & the UK Using Tokenized Money Market Funds Full Report

Scale Your

Digital Finance Strategy

Join an application-layer network of major financial institutions trading billions through multi-chain, cross-market SuperApps

$5B+

$1B

Monthly Trading Volume

Largest Transaction

50+

18

Partners

Total SuperApps

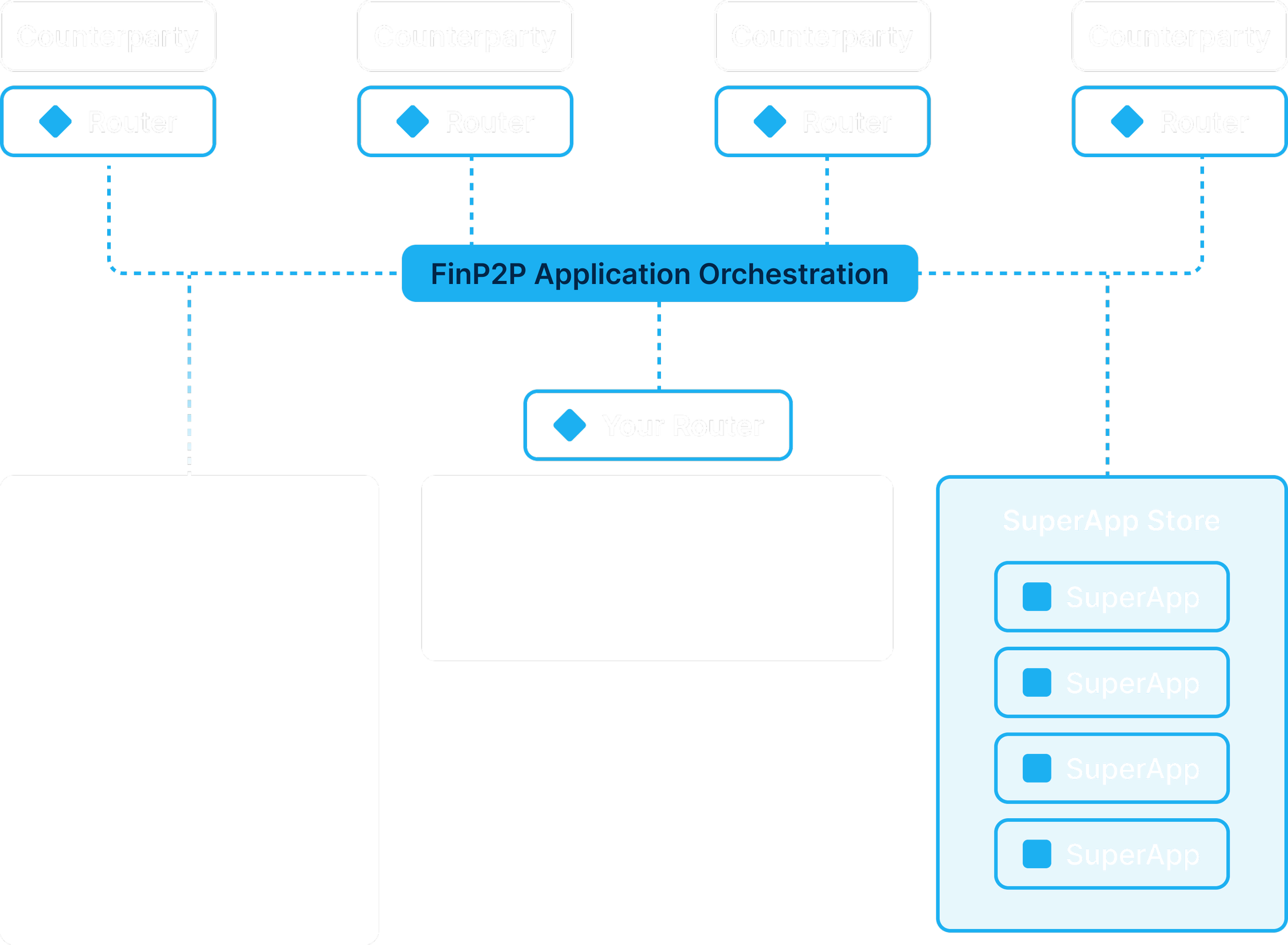

The Application Orchestration Router

Enabling digital asset scalability in three dimensions - Ownera’s routers power multi-chain SuperApps, giving financial institutions instant access to a broad suite of digital applications that connect seamlessly across blockchains, partners, and markets.

Scale Across Blockchains and Legacy

Routers orchestrate transactions natively across any combination of blockchains, smart contracts, and legacy platforms. This is achieved through FinP2P application-layer orchestration and adapters that connect the routers to each network or smart contract — enabling seamless use by SuperApps and network participants.

This open architecture enables scalable interoperability with any legacy platform and supports blockchains such as all EVM-compatible L1 and L2 chains (public or private), Canton, Corda, Hedera, Solana, and any other network via an adapter.

Scale Your Market Reach to any Business Partner

Connect with Zero Integration into a network that is live in production, trading up to $1 billion per given day and continuing to scale.

Scalability comes from eliminating silos and custom integrations, using plug-and-play connectivity, and deploying in parallel across multiple clients, suppliers, service providers, and technology partners in the financial industry.

Scale Across Business Applications

This is where the network effect comes into play - deploy the SuperApps that best fit your needs, from an open and competitive apps market:

Trading any asset class

On combination of blockchain and legacy

Aggregating supply, demand & liquidity

Mix & match apps (e.g. trading + repo)

“The router turns complex bilateral integrations into plug-and-play, many-to-many connectivity. SuperApps build on that foundation so that, instead of solving one problem at a time, you benefit from the entire industry solving every problem together.”

How It Works

FinP2P is an open Application Orchestration Layer for financial markets - much like TCP/IP was for the internet - seamlessly connecting blockchains, institutions, and users across an unlimited universe of applications.

Technically, it unifies user and asset identities (with the wallet address as the equivalent of a TCP/IP address), enables peer-to-peer communication between financial institutions, and orchestrates blockchain-native transactions in a fully distributed way across participants.

1. Leverage Your Platforms & Smart Contracts

Connect the router to your own platforms and blockchain smart contracts once - this is the only integration you will need:

Utilize ready-made router connectivity tools, including adapters and system apps, such as the Universal Blockchain Connector.

Use the router's unified API to build custom adapters for any proprietary need.

2. Connect to the Market - ZERO Integration

Connect your router to the routers of your counterparties, and set permissions.

No need to integrate to any of their platforms - the routers will handle the routing, orchestration and interoperability with all blockchains, platforms and SuperApps - using the FinP2P protocol.

3. Deploy SuperApps for Your Business Cases

Deploy SuperApps for any asset class and use case.

Access an open store where developers can innovate and compete. Say goodbye to silos, and connect with an ecosystem of counterparties and applications with market-wide liquidity.